Amazon Seller Accounting Software: A Quick Guide

As an Amazon seller, you have various financial matters to keep tabs on, such as income, expenses, and taxes. But, managing all of this manually can be overwhelming due to the high volume of transactions. That’s where accounting software comes in – it’s designed to automate these tasks and make your life easier.

In this blog, we’ll cover everything you need to know about Amazon seller software, from how it works to why you should use it, who can benefit from it, and how to choose the right one.

Select the plan that best suits your needs and begin your journey today.

What Is Amazon Accounting Software?

Amazon Seller Accounting Software is a specialized digital tool designed to help Amazon sellers and eCommerce businesses manage their financial transactions and maintain organized books through automation.

Instead of manually dealing with numbers and spreadsheets, this software makes the accounting process easier, saving you time and reducing the risk of errors. Research shows that around 64.4% of small and mid-sized retail and eCommerce sellers use this type of software to handle their finances.

How Does it Work?

The software provides a central dashboard for all your Amazon transactions.

When you link it to your Amazon Seller Central Account, it automatically connects and imports your sales data, expenses, and other vital financial information.

Once the data is in, the software then takes over and expertly organizes this information into easy-to-read reports and dashboards. This helps you see clearly how your business is doing financially.

What Can Seller Accounting Software Do for You?

The features offered by accounting software can vary depending on the specific tool you choose. However, there are some common features that are typically included in most Amazon accounting software options:

– Automated transaction tracking

– Financial report generation including profit and loss statements, balance sheets, and cash flow statements

– Invoice generation

– Expense tracking

– Inventory tracking features including inventory levels and cost of goods sold

– Tax calculations, including sales tax calculations and income as well as sales tax summaries

– Payroll and employee management

– Annual and monthly transaction statements

– Bank reconciliation

– Multi-channel support

– Budgeting and forecasting features

Why Do You Need to Use Software?

Amazon seller accounting software isn’t just a tool for convenience; it’s a must-have regardless of the scale of your operations. Here’s why using this software is a must:

1) Improved Accuracy

Accounting software makes your accounting tasks much easier by doing away with guesswork and tedious manual work. It’s designed to process numbers accurately and quickly, something that manual methods can’t do as well. This means you can trust your financial records to be error-free and completed in a fraction of the time.

2) Effortless Tax Management

Taxes are a crucial yet complex part of your business. Accounting software simplifies this process by organizing your financial data in a tax-ready format.

It also tracks deductible expenses and ensures compliance with sales tax regulations, making tax filing less stressful and simpler. This, in turn, lowers the risk of penalties or audits.

3) Saves Time

As an Amazon seller, you’re busy enough. With accounting software taking care of your day-to-day financial tracking, you can save countless hours that would otherwise be spent on data entry and calculations.

This valuable time can be put to better use in strategizing, sourcing new products, or improving customer service – activities that directly help your business grow.

4) Provides Valuable Financial Insights

Accounting software isn’t just about tracking numbers; it creates detailed reports that offer valuable insights into your business’s financial performance. These reports help you identify your most profitable products, keep an eye on cash flow, and plan for future growth – all of which are crucial for your business to succeed.

Who Needs to Use Amazon Accounting Software?

Amazon Seller Accounting Software can be beneficial for different types of Amazon sellers, including:

New and Small-Scale Sellers: If you’re just starting out or operating on a smaller scale, automated software will help you manage your finances in an affordable manner.

Hands-On Sellers: If you prefer to be actively involved in all aspects of your business, including finances, bookkeeping software will help you maintain complete control.

Businesses with In-House Accounting Staff: If you already have an accountant or financial team in place, bookkeeping software can complement their efforts and help reduce the risk of human errors.

Sellers with Basic Accounting Knowledge: If you have basic accounting and taxing knowledge or are willing to learn, software can help you out.

Sellers Prioritizing Data Security: If you’re concerned about the security of your financial data, particularly when sharing it with third parties, software can be a more secure solution compared to hiring an external agency.

Can You Use Spreadsheets Instead of Software?

This is not recommended for several reasons.

Firstly, when you manually enter data, you’re more likely to make mistakes like typos or miscalculations. These errors can impact your financial records and lead to costly decisions. A popular example of this occurred in 2005 when Kodak lost $11 million because of a typo in severance calculations.

Secondly, manual bookkeeping takes up a lot of time, especially for Amazon businesses. You’ll spend a big chunk of your day entering, categorizing, and checking transactions. That time could be better used for other important tasks.

Third, specialized tools often provide helpful dashboards, tips, and insights that are gathered from analyzing data. If you rely only on spreadsheets, you might miss out on these.

Lastly, as your business grows, you’ll have more financial tasks to manage, and handling a complex spreadsheet with so much data can get overwhelming. Even experienced Amazon accountants and bookkeeping agencies use software to handle their financial tasks. So, make the most out of it for the benefit of your business.

How to Choose the Best Accounting Software for Amazon Sellers

Here are a few factors to consider when choosing Amazon accounting software:

1) Seamless Integration and Key Features

When choosing bookkeeping software for your Amazon business, make sure that it can automatically link to your Amazon Seller Account and any other accounting tools that you use. Like this, it will be able to import your sales data, fees, and other vital information without you having to manually input anything.

Also, check what features the software comes with. Some basic tools that you’ll need include inventory management, bank reconciliation, and the ability to generate financial reports like profit and loss statements, balance sheets, and cash flow statements. Also, make sure the software uses double-entry accounting. This is more accurate than single-entry accounting.

2) User-Friendly Interface

Make sure to go for a bookkeeping software tool that’s simple to use. Avoid complicated programs that require you to have an accounting degree to understand how to use it. Instead, go for software with a user-friendly interface and easy-to-understand features.

3) Reliable Customer Support

Even when using the most user-friendly software, you may require some help from time to time. Look for bookkeeping software providers that offer good customer support. They should be available through email, chat, or phone, whichever is most convenient for you.

4) Opt for Cloud-Based Accounting Software

Consider using bookkeeping software that comes with cloud-based features. This will allow you to access your financial data from anywhere with an internet connection. Also, these solutions usually come with automatic data backup, which will keep your financial information safe.

5) Budget Consideration and Free Trial Availablity

When you’re choosing bookkeeping software, think about your budget. Some options might cost more at the start but may come with valuable features that may change how you run your business.

To make sure you’re not making a mistake, pick a program that offers a free trial so you can try it out first without committing. It’s better to stay away from free accounting software tools since they often lack the essential features you need to effectively run your Amazon business.

6) Ability to Scale

Your Amazon business will grow over time, so it’s important to select software that can scale with you. Make sure the software has different pricing options or extra features for larger businesses. This way, your bookkeeping stays effective no matter how big your business gets.

The Best Bookkeeping Software Tools

Now that we’ve covered the key factors to consider when selecting the right software tools, let’s take a look at the leading Amazon Bookkeeping Software Tools:

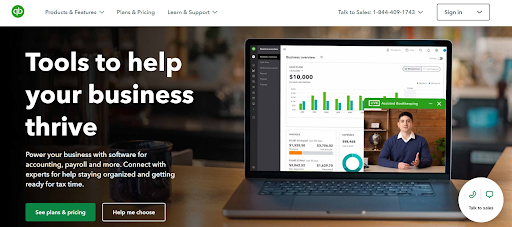

QuickBooks Online

QuickBooks Online is one of the most widely recognized and extensively used cloud-based accounting software solutions in the United States. Trusted by approximately 5.9 million businesses, it comes with multiple features, extensive reporting systems, and seamless integration options for both Amazon and other eCommerce sellers like eBay.

Key Features Included:

– Double entry accounting

– Integrates with dozens of apps commonly used by Amazon sellers

– Ability to track sales tax based on the provided address

– Free guided setup

– Inventory management and inventory tracking

– Detailed financial reports

Who Is It For?

Suitable for accountants and enterprise sellers who have advanced accounting knowledge.

Pricing:

QuickBooks Online provides 4 subscription options. However, only the ‘Plus’ and ‘Advanced’ plans are suitable for Amazon sellers:

– Plus Plan: $90/month for up to 5 users.

– Advanced Plan: $200/month for up to 25 users.

Additionally, QuickBooks Online offers a 30-day free trial and a 50% discount for the first 3 months for new subscribers.

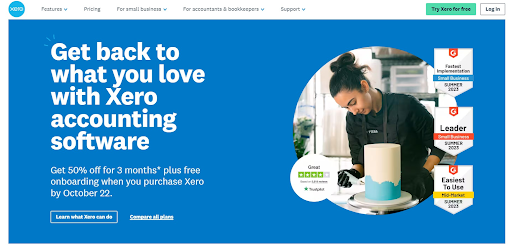

Xero

Founded in 2006, Xero has over 1.8 million global subscribers, making it one of the most popular accounting software solutions available. This cloud-based accounting software offers a user-friendly platform suitable for a wide range of users, including those without extensive bookkeeping expertise.

Key Features Included:

-Double entry accounting

– Handles essential accounting tasks: cash flow, bank reconciliation, and expense management

– Inventory tracking

– Integrates with more than 800 apps

– Sales tax compliance

Who Is It For?

Beginner sellers that have limited accounting knowledge.

Pricing:

Xero has 3 different pricing plans that you can choose from:

– Early Plan: $13/month

– Growing Plan: $37/month

– Established Plan: $70/month

There is also a free 30-day trial that you can opt for before subscribing to a plan.

A2X

A2X is not your typical cloud bookkeeping software but rather an add-on designed to enhance the functionality of other Amazon seller accounting tools. Its primary function is to retrieve essential data, such as the COGS and seller inventory status, directly from your Amazon account. It then categorizes this data and seamlessly integrates it into software platforms like QuickBooks Online and Xero. Without A2X, the process of manual data entry and categorization would be tedious and prone to errors.

Key Features Included:

– Automatic transaction posting to Xero/Quickbooks Online

– Features accrual accounting – revenue and expenses are recorded as soon as transactions occur

– A full breakdown of Amazon selling fees and other expenses

– Tracks applicable tax rates for every transaction

– Automates Cost of Goods Sold by-product

– Reconciliation of transactions with bank deposits

Who Is It For?

Mid-sized Amazon sellers who manage large volumes of data and want a solution to simplify their bookkeeping tasks.

Pricing:

A2X offers 4 pricing tiers for Amazon sellers:

– Mini Plan: $19/month (cap at 200 orders)

– Starter Plan: $49/month (cap at 1,000 orders)

– Standard Plan: $69/month (cap at 5,000 orders)

– Standard 10k Plan: $139/month (cap at 10,000 orders)

Freshbooks

Established in 2002, FreshBooks has a user base of over 30 million users. It is an excellent choice for Amazon FBA sellers looking for user-friendly accounting software. It operates as a cloud-based solution and provides an extensive array of features, all at an affordable rate when compared to the other alternatives listed here.

Key Features Included:

– Sales tax summaries

– Inventory tracking and inventory management

– Simplified financial reports: expense reports, profit & loss reports, balance sheet

– Professional invoice creation

– Multi-currency feature

Who Is It For?

Ideal for budget-conscious small business owners with limited tech skills or accounting knowledge.

Pricing:

FreshBooks offers 3 pricing plans, each with a 50% discount for the first 4 months and a free trial option:

– Lite Plan: $17/month – includes 5 billable clients

– Plus Plan: $30/ month – includes 50 billable clients & extra features

– Premium Plan: $55/month – unlimited number of billable clients and a host of new features

LinkMyBooks

LinkMyBooks was created especially for Amazon sellers and other eCommerce merchants, including those on eBay, Walmart, and Shopify. Similar to A2X, it efficiently categorizes your sales, refunds, fees, and taxes, and then seamlessly integrates a concise summary directly into your accounting software, such as Xero and Quickbooks. It claims to be user-friendly while delivering a host of valuable features.

Key Features Included:

– Easy guided setup

– Sales tax calculation

– COGS tracking

– Generates a clean summary invoice detailing sales, refunds, fees, and VAT

– Reconciliation of transactions with bank deposits

– Support for all Amazon marketplaces

Who Is It For?

Suitable for sellers of all levels who want to automate their bookkeeping tasks and maintain accurate financial records.

Pricing:

LinkMyBooks has 3 pricing plans that you can choose from:

– Lite Plan: Starts at $17/month

– Pro Plan: Starts at $29/month

– Premium Plan: Starts at $56/month

FAQs

Can I switch to a different accounting software if I’m not satisfied?

Yes, you can switch anytime. Most software offers data export features, making it easier to transition without losing your financial history. Just make sure your new choice can import your old data smoothly.

Can accounting software handle multiple currencies?

Yes. Most accounting software solutions are able to handle transactions in multiple currencies. Check the software’s features for multi-currency support.

Can I manage payroll through Amazon seller accounting software?

Yes. Some options come with payroll and employee management features that help you manage payrolls, calculate taxes, and even track employee hours all in one place.

Summary

When it comes to managing the financial aspect of your Amazon business, the right accounting software is a game-changer. It streamlines your operations, keeps your finances in check, and gives you valuable insights to help your business thrive.

Looking for expert assistance in managing your Amazon seller account? Enso Brands offers a comprehensive range of one-stop Amazon services tailored to optimize your performance and maximize your potential on the platform. Contact us today and discover how we can help your business thrive on Amazon!

Transform Your Amazon Presence: Unlock Sales and Dominate with Our Ultimate Listing and Design Templates!

-

Expert advice and insider tips on creating a perfect Amazon listing

-

Product Insert Template

-

Product Packaging Template

-

Amazon Posts Template

Ready to elevate your Amazon business? Our expert team at Enso Brands is here to provide tailored solutions that drive results.